Toronto Real Estate Market Outlook: Why 2026 May Mark the Bottom of the Cycle

After nearly four years of declining sales and price corrections, the Toronto real estate market appears to be approaching a critical inflection point. In hindsight, 2026 is likely to be viewed as the low point of the current housing market cycle, setting the stage for a more stable and sustainable recovery beyond this year.

This outlook is supported by improving market fundamentals, easing interest rate pressures, and mounting evidence of pent-up demand across the Greater Toronto Area.

A Market Quietly Stabilizing Since 2024

Revised data now shows that housing activity actually improved modestly in 2024, with sales rising approximately 1% compared to 2023. While hardly a boom, this was a meaningful shift after several years of contraction and signaled that the market was beginning to emerge from its post-pandemic correction heading into 2025.

Buyers responded to:

-

Lower borrowing costs,

-

Moderating home prices, and

-

Improved affordability relative to the 2022 peak.

However, the recovery proved uneven.

What Went Wrong in 2025? Confidence, Not Fundamentals

The primary setback in 2025 was not affordability or supply, but a sharp drop in consumer confidence. Economic uncertainty caused many buyers to delay major life decisions, even as conditions improved.

By late 2025, confidence began to recover as:

-

Interest rates declined to their lowest level in four years,

-

Economic uncertainty eased, and

-

The S&P/TSX delivered a 30% annual return, improving household balance sheets.

Despite this progress, surveys suggest buyer sentiment remains fragile. Caution is likely to persist in the near term, limiting the pace of any rebound.

Context Matters: The Correction Was Necessary

To understand the current downturn, it’s important to consider what preceded it.

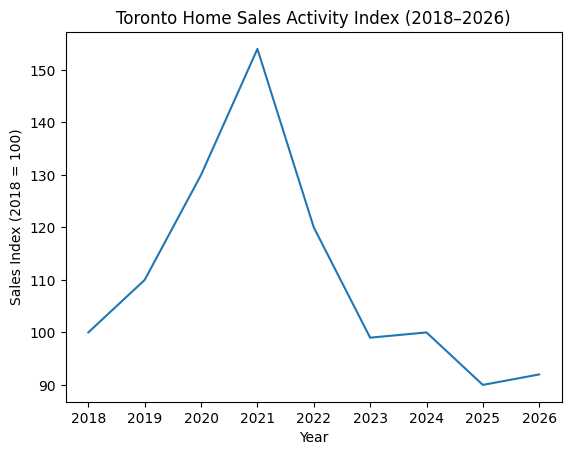

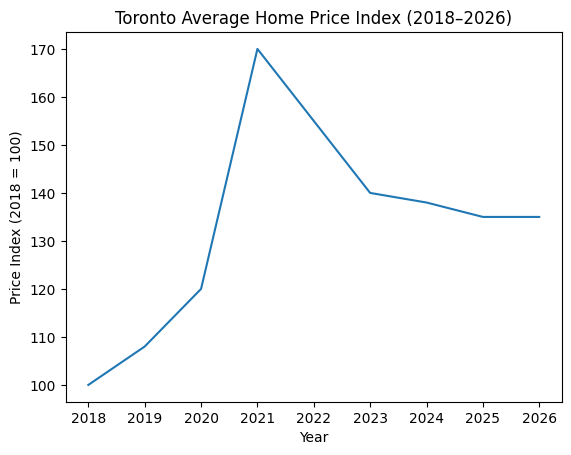

Between 2018 and 2021, Toronto home sales surged 54%, while average prices rose more than 70% in just three years, peaking in early 2022. This pace of growth was excessive and unsustainable, particularly once interest rates began rising.

While the correction has been painful, it has also been constructive:

-

The 10-year average for sales (90,000 transactions) remains intact.

-

Long-term price growth of approximately 6% annually continues to align with historical norms.

In that sense, the downturn has helped realign the Toronto housing market with its long-term trajectory.

Pent-Up Demand Is Building Across the GTA

There is a natural limit to how long housing demand can be deferred. Recent data shows that home sales as a share of population are at their lowest level in more than 30 years, highlighting the depth of suppressed demand.

This is occurring despite substantial population growth:

-

The GTA has added more than 600,000 residents since 2020.

-

While federal policy is slowing the pace of non-permanent resident growth, the underlying demographic pressure remains significant.

Life events such as family formation, job changes, and downsizing cannot be postponed indefinitely. This demand will eventually re-enter the market.

2026: High Listings, Flat Prices, and a Holding Pattern

Looking ahead to 2026, several factors suggest a period of price stability rather than volatility:

-

Affordability has improved but remains challenged.

-

Sales are expected to remain below long-term averages.

-

Active listings are likely to stay near record highs, driven by:

-

A wave of mortgage renewals at higher interest rates,

-

Sellers who delayed listing during weaker conditions now re-entering the market.

-

There is broad consensus among economists and financial markets that interest rates will remain largely unchanged through 2026, removing a key catalyst for price movement in either direction.

The result is a market that is likely to trade sideways, with limited price appreciation but improving transactional activity.

First-Time Buyers: The Key to Recovery

Historically, sustainable housing recoveries begin with first-time buyers, and there are encouraging signs on this front. Sales momentum has been strongest in:

-

Entry-level freehold homes, and

-

Condominiums.

As this segment continues to strengthen, it should support increased transaction volume further up the housing ladder.

Condo Market Turning a Corner in Toronto’s Core

The condominium market is showing early signs of rebalancing:

-

Inventory has begun to level off.

-

New supply is expected to decline as construction completions slow, particularly within the City of Toronto, where development peaked earlier than in the surrounding 905 regions.

Additional tailwinds include:

-

Return-to-office mandates,

-

Stabilizing rental rates, and

-

Reduced future supply.

Together, these factors are likely to help restore buyer confidence in Toronto’s condo market throughout 2026.

Final Thoughts: A Foundation for the Next Cycle

While the Toronto real estate market is unlikely to experience a rapid rebound this year, the evidence increasingly suggests that the worst of the cycle is nearing its end. Price stability, improving confidence, and rising first-time buyer activity are laying the groundwork for a healthier and more balanced market.

For buyers, sellers, and investors alike, 2026 may ultimately be remembered not as a year of decline—but as the turning point that reset the market for the next decade of growth.